5 minute read

For six years, students from The Australian National University (ANU) College of Business and Economics (CBE) have advanced their professional development through involvement with CBE’s dynamic Student Managed Fund (SMF).

The SMF course is a deep, activity-based and fully accredited learning opportunity to manage investments worth over A$700,000, comprised of donations made to ANU, with the intent that the funds are managed by students, and gains are used to support philanthropic activities.

Under the supervision of the program’s conveners, students enrolled in SMF make investment recommendations that are reviewed and endorsed by an Investment Advisory Committee (IAC).

Under the supervision of the program’s conveners, students enrolled in SMF make investment recommendations that are reviewed and endorsed by an Investment Advisory Committee (IAC).

CBE double degree student Lauren Vanstone, studying a Bachelor of Commerce (majoring in Finance) and a Bachelor of Accounting, currently acts as the Chief Investment Officer for SMF. She’s responsible for the effective management of the fund’s day-to-day operations and is involved in strategic planning for its future.

“I oversee and monitor the fund’s performance while also providing approval for the investment processes utilised by the sub-teams. This multi-faceted role allows me to contribute significantly to the fund’s success,” she says.

Lauren expressed that one of the many benefits of SMF is the way that learning outcomes are equivalent to industry experience.

It offers practical insights into teamwork and fund management that go beyond traditional classroom learning.

Looking back

The concept of SMF arose in 2016 from a group of ANU finance students who noticed there was an applied framework missing from their learning experience. They felt a more practical set of offerings was needed.

CBE alumnus and SMF co-founder Karan Savara, a first-year student at the time, approached the head of a commerce society and pitched a one-page proposal. The response, he says, was not entirely positive.

After an unenthusiastic reception, the next stage was creating a petition to gather support and build momentum – students, tutors, and lecturers banded together to generate a three-page manifesto that centred on three pillars, one of them being a student managed fund.

This petitioning led to the formation of the student society Trading and Investments Collective (TIC), which would eventually lead a forum to discuss the terms of lobbying to ANU.

As a result, Karan connected with Associate Professor Geoff Warren, who became an avid supporter and would end up as the fund convener of SMF. Geoff engaged with the TIC’s ideas, and started presenting at their society events.

The lobbying proved successful, and from the TIC, SMF was born. This was largely made possible by seed donor and ANU alumnus Russell Clark, whose generous donation was then matched by the ANU Research School of Finance, Actuarial Studies and Statistics (RSFAS) on behalf of the University. You can view SMF’s donors here.

Shortly after, Dr. Anna Reibnitz joined the fund as the course convener.

The journey so far

SMF has since flourished from a virtual portfolio that managed fake money and focused on currency trading, to a fully-fledged investment fund with a multi-asset portfolio that enables students to work in four sub-teams: Active Australian Equity, Asset Allocation, Risk and Compliance, and Relationship.

SMF has since flourished from a virtual portfolio that managed fake money and focused on currency trading, to a fully-fledged investment fund with a multi-asset portfolio that enables students to work in four sub-teams: Active Australian Equity, Asset Allocation, Risk and Compliance, and Relationship.

Geoff and Anna have been long-standing conveners of the fund, and recently retired after years of successful stewardship. Both have relished its achievement as a viable fund and the opportunity to see it and the students evolve.

“I have been most proud when SMF alumni tell us they have landed a really good job, and that the SMF was not only integral to them getting the offer, but that it gave them a big head-start in the role,” says Geoff.

"We discovered that students learn much more than just investing, but also softer skills, like how to work in a professional team-based environment – to take charge and accept responsibility."

Anna shared that SMF’s holistic approach to learning is what makes it a rich experience for participants.

“Students work as a team in an industry environment with real philanthropic benefits, but in a safe teaching space entirely focused on their learning and growth. This holistic experience is rare at university," she says.

She also echoed Geoff’s reflections on watching students grow through the SMF experience.

Students join relatively inexperienced, and gain technical, managerial, relationship and communication skills that are well above their years. They leave as leaders who are job ready.

Looking to the future

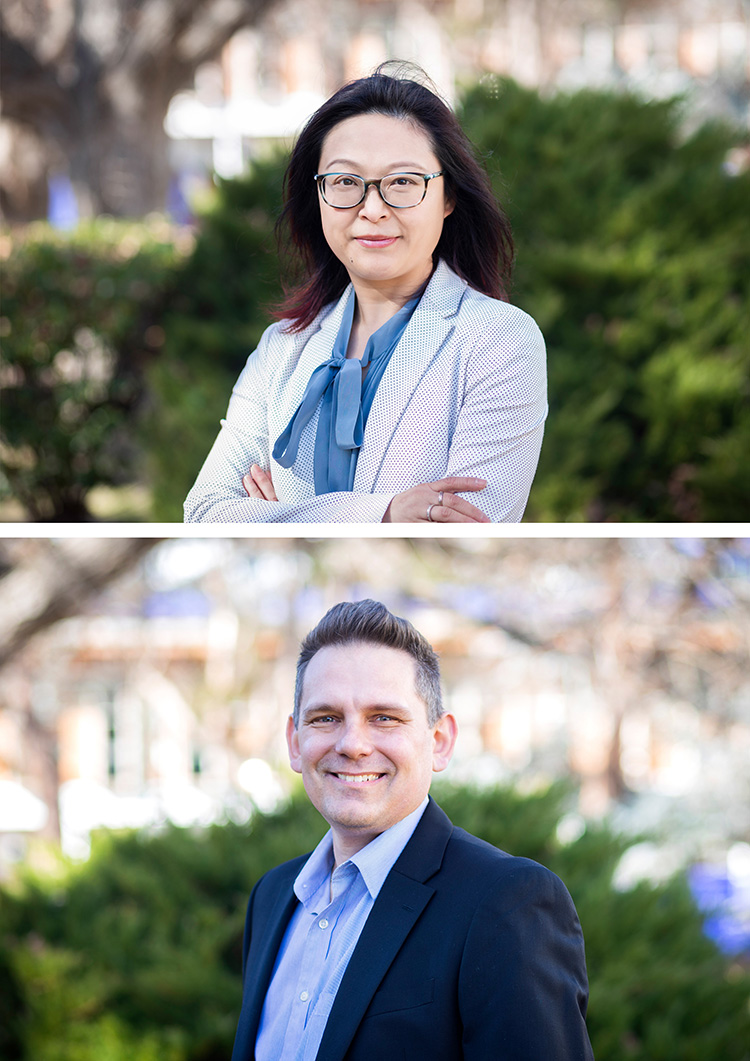

From Semester 2, 2023 students will benefit from the leadership of newly-appointed RSFAS conveners Dr Hua Deng, Course Convener, and Dr Dean Katselas, Fund Convener.

Hua can see that while taking this role will be a challenge vastly different to running any other course, it’s also a rewarding experience for an educator.

“I’ve been reading the Student Managed Fund report that’s circulated within the school for many years,” says Hua. “When I was approached by RSFAS about taking over the responsibilities of course convener, I said yes immediately.”

Dean has already begun to witness how SMF develops professional skills in its students.

“It’s been particularly rewarding to see each student evolve in maturity, confidence, and competency in preparation for potential careers as finance professionals,” he says.

Hua looks forward to utilising the unique skillset necessary to run the fund, and to join Dean, the IAC and prospective participants to continue SMF’s journey.

I’m excited for the opportunity to help safeguard the legacy of the fund and to nurture the next generation of industry leaders down the track.

Dean also looks forward to continuing SMF’s legacy.

“It is my intention, in collaboration with Hua, to continue the hard work of both Geoff and Anna, to ensure that the SMF provides a rewarding experience and solid training ground for future cohorts,” he says.

The ANU Student Managed Fund course provides a 12-unit offering for both undergraduate and postgraduate students and has a competitive application process. Click here to find out more.

The College is always keen to explore research collaborations with the public and private sector and to reconnect with alumni. Please get in touch if you would like to know more about partnering with us.