Take five exceptional actuarial students and one fictional country. Add a handful of late nights, endless model tweaks, and one-too-many coffees, and you get an award-winning solution.

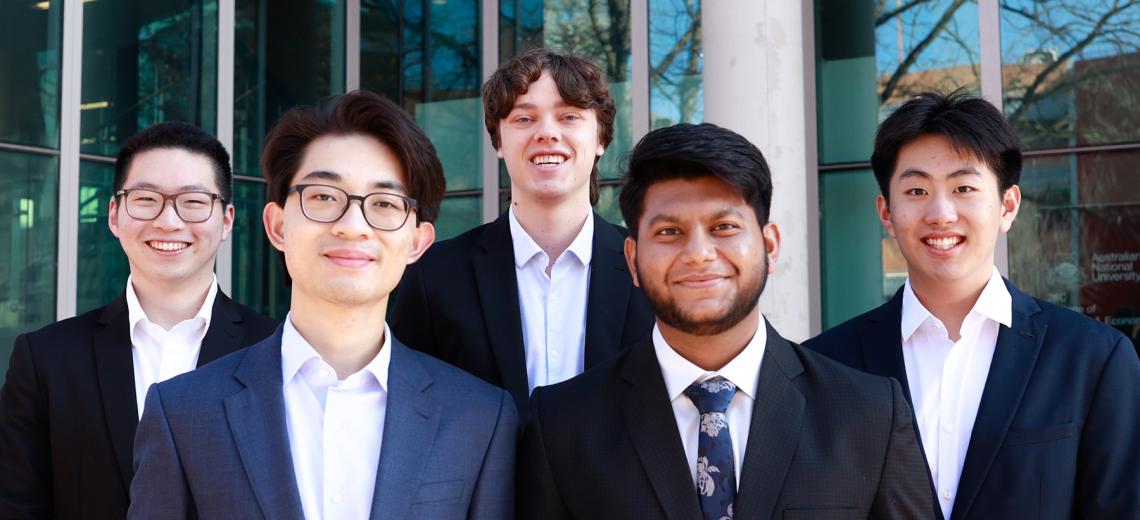

Emil Ong, Olaf Braaksma-Menks, Phan Tien Dung, Richard Tang and Vishesh Gupta recently represented The Australian National University (ANU) in the 2025 Society of Actuaries (SOA) Research Institute Student Research Case Study Challenge, an annual contest open to universities and colleges around the world.

The team of five students, all from the ANU Research School of Finance, Actuarial Studies and Statistics (RSFAS), placed third out of 68 teams competing. Associate Professor Adam Butt, Head of Actuarial Studies at RSFAS, is proud of their result.

“This is a fantastic achievement against a very competitive field,” he says.

Team member Vishesh is also pleased with the team’s achievement.

“It honestly feels surreal – in the best way – to have placed in the top three among so many brilliant teams from around the world. We poured a lot into this challenge, so seeing our work recognised like this is incredibly rewarding.”

Teams were tasked with designing a national insurance program for dam-failure risk in the fictional country of Tarrodan. According to Vishesh, collaboration was key to their success.

“We each brought different strengths and weren’t afraid to challenge or support one another. That made all the difference.”

Team member Richard agrees.

“We divided responsibilities based on our strengths, where some of us focused on actuarial modelling and pricing, while others handled policy design and logistics. Our team’s ability to integrate diverse perspectives played a key role in our strong achievement,” he says.

Thanks to one of his ANU courses, team member Emil felt well-equipped to handle the complex case study.

“Through its use of group assignments involving modelling, simulations and report writing, Actuarial Techniques (STAT3038) significantly developed my ability to communicate and collaborate with group members and relevant stakeholders on real-world actuarial projects,” says Emil.

The team also credits their result with the balance they struck between solid analytics and practical thinking.

“We didn’t just want a good solution on paper. We wanted something that could actually work in the real world,” says Vishesh.

Richard adds: “We consistently refined our ideas to ensure that our recommendations were technically sound, practical and innovative.”

The Case Study Challenge aims to help develop future actuaries, and for the ANU team, this is certainly the case.

“The open-ended nature of the problem required drawing on a broad range of skills and working through decisions that involved difficult trade-offs, which challenged me to think more holistically and adaptively. It allowed me to extend myself in a real-world context,” says Olaf.

Team member Phan gained experience that has prepared him for his future career.

“We had the opportunity to showcase the culmination of our efforts to a group of highly experienced actuaries and experts in the field, an experience that translates well for practical case studies during a technical interview,” he says.

The College congratulates Emil, Olaf, Phan Tien Dung, Richard and Vishesh on their success.

Vishesh Gupta

Vishesh is currently studying a Bachelor of Actuarial Studies, where he’s developed a strong interest in quantitative finance, data analysis and risk modelling. He has always been curious about how maths can help us make better decisions in an uncertain world, and that curiosity has continued to shape his journey. In early 2024, Vishesh was selected as a Casual Sessional Academic and later promoted to Senior Finance Tutor, an experience that’s allowed him to support over 300 students, while experiencing personal growth. He also received the RSFAS Scholarship, which has been a big encouragement along the way.

Richard Tang

Richard is currently in his third year studying a double Bachelor of Actuarial Studies and Finance. His interest in actuarial studies began with a strong passion for mathematics in high school, which led him to explore actuarial science to apply analytical thinking to real-world problems. He is particularly drawn to actuarial consulting, where technical modelling intersects with strategic business decisions. Outside of studying, Richard has been involved in the ANU Actuarial Society last year as the marketing director and FMAA this year as a sponsorship director. These roles have helped him build industry connections and develop soft skills through team-based initiatives and events. He is now working toward completing his actuarial exams and exploring opportunities to apply his skills in a consulting environment.

Phan Tien Dung

Phan is currently in his third year of a Bachelor of Actuarial Studies. Before coming to Canberra, he completed high school in Western Australia. Since then, he has developed a strong interest in data and quantitative thinking to solve real-world problems. Career-wise, Phan has interned at a life insurance company, where he gained some hands-on experience in product pricing, as well as working on a career program at CBE. These experiences have shaped his understanding of the actuarial profession and the value of practical, data-driven work.

Olaf Braaksma-Menks

Olaf is a fourth-year student currently studying a double Bachelor of Actuarial Studies and Finance. He lived in Sydney and moved to Canberra to study a double degree in Actuarial Studies and Medical Science at ANU. In his second year, Olaf transitioned away from Medical Science to Finance to focus more deeply on the actuarial component of his degree and develop a stronger foundation in finance.

Emil Ong

Emil is currently an actuarial student in his final year. Since 2022, he has been studying a double degree in Actuarial Studies and Accounting, and he plans to do his Honours in Actuarial Studies next year. Throughout his degree, Emil has been tutoring Actuarial courses such as STAT2005 and STAT2008/2014. In addition to this, he has worked casually as a private tutor, worked part-time as an undergraduate consultant at Equity Partners, and most recently worked as an Actuarial Consulting Intern at Mercer.